The short answer is yes!

HDB, a cornerstone of Singapore's housing policy, exemplifies the government's commitment to providing affordable housing for all Singaporeans. Notably, it offers spaciousness, with 4-room flats starting at 900+ square feet, surpassing the size of some private housing options, all while being significantly more cost-effective. 2 times the size of a condo but 5 times cheaper! In modern estates, ample amenities such as malls, shops, and food options can often be found right below the block. For couples who secure a BTO flat, the entire journey, from the exhilaration of balloting and selecting their desired unit to years of anticipation leading up to finally moving in, is filled with unforgettable moments. It is not uncommon for couples to even have their first child born within the walls of their HDB home, imbuing it with cherished memories.

The comfort and nostalgia associated with HDB living make it an immensely desirable long-term forver home. It it no wonder that our parents' generation has grown so fond of their HDB homes that they are unwilling to part with them, regardless of the enticing prices they may command in the market. And this sentiment is perfectly understandable.

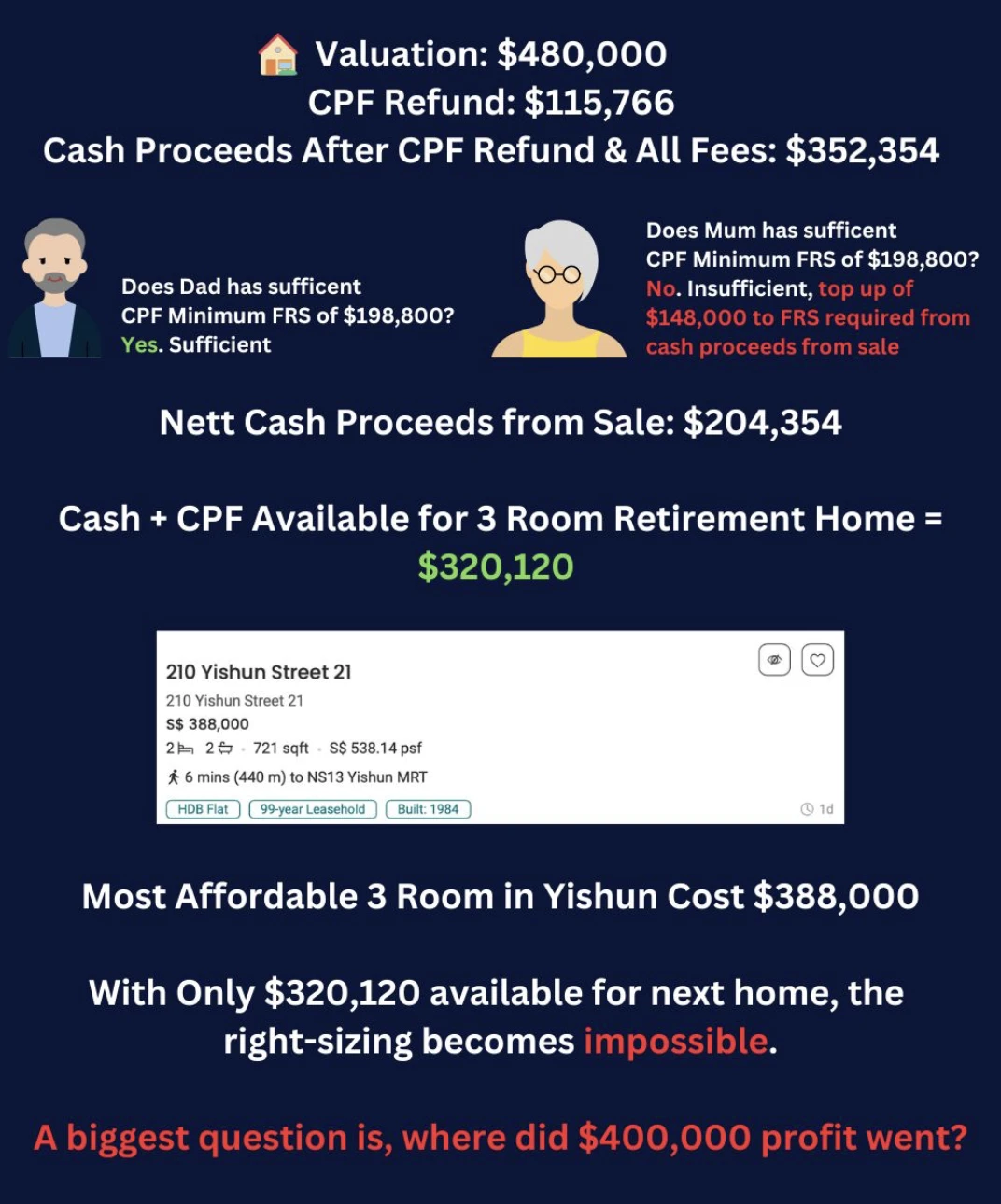

Having spent my own upbringing in an HDB flat, I have truly appreciated the spaciousness and myriad benefits it offers. With the recent surge in HDB prices across the board, my parents' 60-year balance flat, which was previously valued at just over $300,000, is now appraised at an impressive $480,000. Naturally, my parents became excited and exclaimed that they had garnered an astonishing profit of $400,000, considering they had purchased the flat for a mere $80,000 34 years ago. In a serious tone, they expressed their intention to sell the current home and downsize to a 3-room flat, as my brother and I will soon be moving out after getting married

Here's the calculation:

Mystrey: Where did the $400,000 profit went when she purchased only at $80,000 and will be able to sell at $480,000?

1) CPF Refund:

The initial CPF amount used, which was $50,000, has accumulated over the past 34 years and grown to $115,766. This represents a total of $65,766 in cash proceeds that will be refunded through CPF.

2) Full Retirement Sum Top-Up:

As my mum do not have sufficient funds in their CPF accounts to meet the Full Retirement Sum (FRS), any cash proceeds from the sale must be refunded and used to top up the CPF retirement amount. The current FRS stands at $198,800 per owner after reaching the age of 55. In this case, my dad has sufficient funds, but my mum does not. Consequently, $148,000 of the cash proceeds is used to top up her FRS.

The profits did not actually disappear. In fact, my parents' CPF accounts have grown richer by $213,766. Unfortunately, these funds are not available as cash. However, it is important to recognize that CASH is essential during retirement to ensure comfort and the ability to travel the world.

Despite having available cash proceeds and usable CPF funds totaling just $320,000, they are unable to downgrade to a 3-room flat at retirement age. Even if I were to negotiate skillfully and secure a unit for $320,000, the lack of additional cash for retirement from the house sale renders the effort of downsizing from a larger home to a smaller one without any benefit illogical.

It was disheartening for them to realize that despite a supposed profit of $400,000 after 34 years, they were unable to enjoy any real cash from it in their retirement years and for a better lifestyle with actual cash. Things could have been significantly different had they started planning for this earlier in their 30s, 40s, or even 50s.

They had always believed that their current home would be their first and final residence, providing them with comfort for a long time. However, this came at the cost of compromising their future options, leaving them with limited choices now that they have reached retirement age.

Wouldn't you agree that having options in life is a luxury? After all, we cannot predict what will happen at any point in our lives. Why not start planning in advance before it is too late?

So can HDB be a forever home? It really depends...

Each family and individual situation is unique, and it is true that some may have the financial means to retire comfortably even with the lease decay and accrued interest. To be 100% sure, it is advisable to assess whether you can afford to make your current home your forever home. It is essential to consider the options available to safeguard your retirement and ensure that your largest asset, your flat, does not become a liability in the future.

Want a complimentary evaluation?

Or learn what kind of upgrade (not private) you can do without breaking the bank yet still be able to safeguard the value of your home?

You know which button to hit to contact me for one. Speak soon.