Let's dive into the HDB market today to explore your options as an HDB owner and assess whether your current asset can support you through retirement. With soaring property prices, we've witnessed some record-breaking HDB transaction prices in recent years. The lifestyle and ambitions of the younger Singaporeans have evolved tremendously as compared to their parents. Many more young HDB owners are seeking upgrades to private homes. Are you one of them looking to upgrade?

I understand that this might be a daunting process for some as there are many factors to consider and especially if you are not familiar with the nuances and lack the insights of the market.

The illustrations probably can sum up the concerns one might have regarding investment in private homes.

Factors such as the fear of servicing heavy mortgage loans, incurring additional expenses each month, and the constant nagging by the older generation telling us that HDB as the first purchase is the safest bet and to work hard & save so as to have a better retirement.

It may then seem easier to just avoid this discussion altogether and choose the comforts of being ignorant and continue happily staying in your current home – because ignorance is bliss, isn’t it? It isn’t a bad choice or wrong choice, but ultimately, is that the best choice for one who yearns for a better lifestyle or earlier retirement?

Continue reading this article if you want to nd out what’s best for you. I am pretty sure by the end of this article; you’ll have a good idea of what’s the best move that would benefit both you and the family.

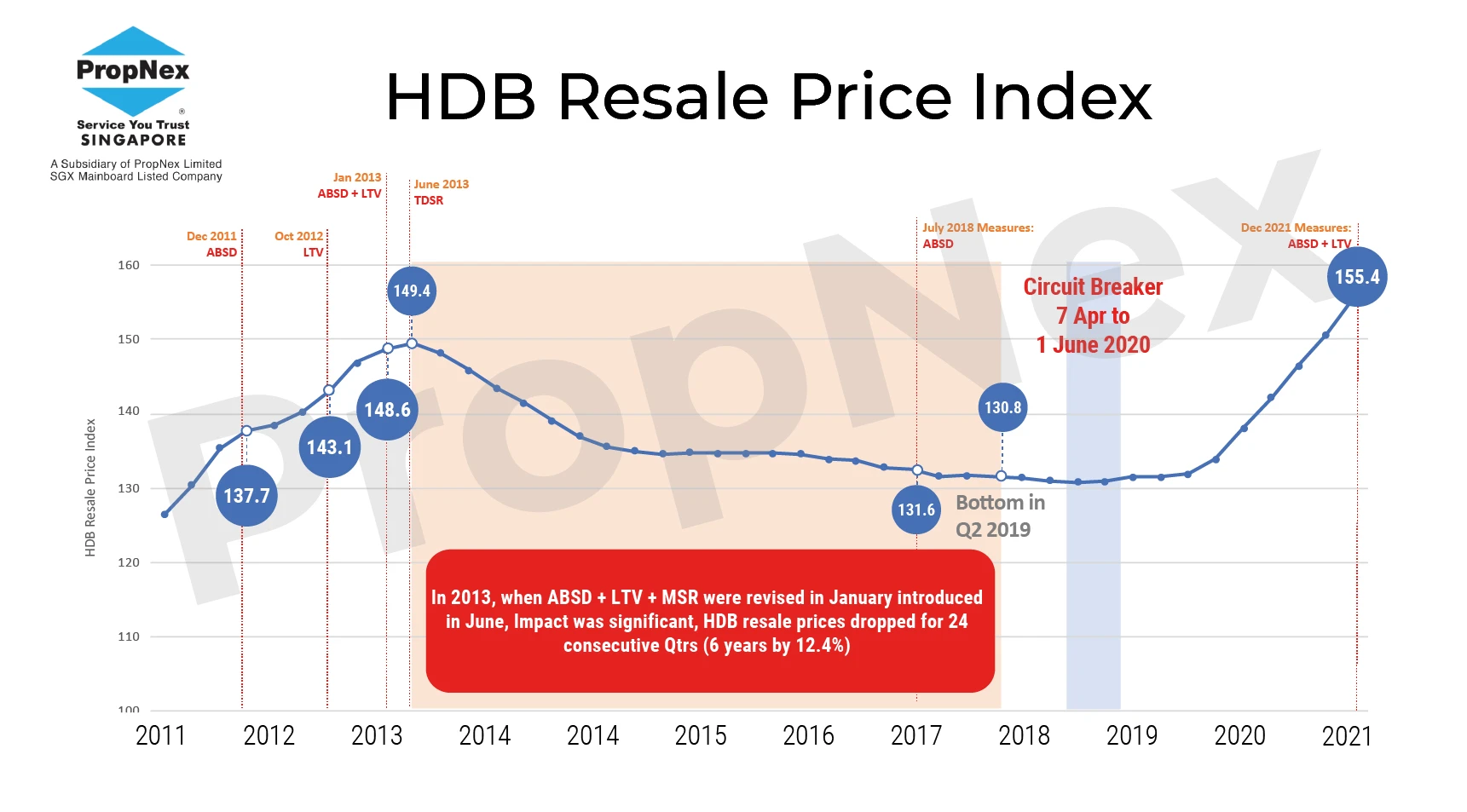

Let us examine the HDB price movement chart (Figure 1) below, which tracks the quarterly resale price index over a 10-year period from 2011 to 2021. In 2013, the government implemented a cooling measure that mandated all HDB buyers' loans to be based on their Mortgage Servicing Ratio (MSR). This move had an impact on HDB prices, causing the market to dip for several years before rebounding in 2019. Many people wonder why the government implemented this measure. The aim was to curb the rising HDB resale prices, which would make the resale HDB market unaffordable for many young couples. Ultimately, isn't it crucial for our elected representatives in Parliament to ensure that public housing remains affordable for generations to come?

Although it took around 8 years for the HDB resale market to recover its previous peak, HDB owners had many opportunities during that period to benefit from the market. In particular, those who held onto their flats since the peak in 2012/2013 were able to upgrade to an Executive Condominium or private property and enjoy significant capital gains. Don't worry if you feel like you've missed out, there are still ample opportunities waiting for you. However, the question remains: how long will this window of opportunity last? While it's impossible to predict, it's essential to seize the moment and avoid making similar mistakes. Later in the article, we'll examine some examples of individuals who took action and reaped the rewards.

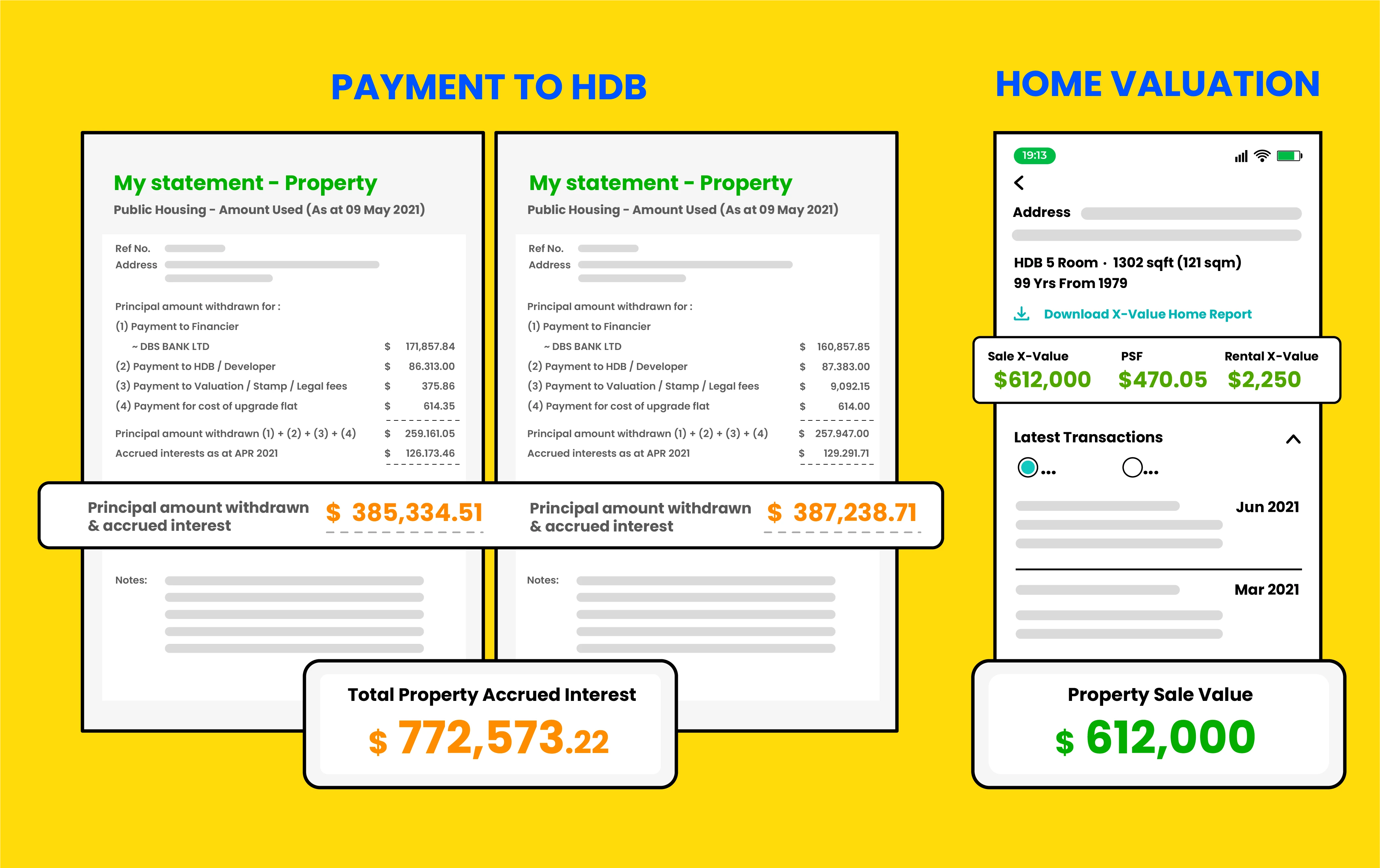

But before that, let's take a look at a particularly sad case of a hardworking couple who kept their HDB at for 30 years expecting it to appreciate. But lo and behold they actually made a colossal loss of more than $160,000.

As you can see below, the combined amount paid for the at is over $700,000, and unfortunately, the valuation of the at is only about $612,000. This loss you witnessed here is lost due to the accrued interest by CPF . Can your price rise enough to defray the interest incurred by your mortgage loans and CPF interest?

When your parents tell you to buy an HDB and stay there until you're old, does that strategy still work? After understanding the example below, do you want to end up with a loss when you're 65 and are about to retire?

In late 2021, our government introduced another round of cooling measures to slow down the red-hot property market. The latest slew of additional measures has seemingly little impact on the HDB market even with their plans to increase the supply in the market and the introduction of the new Prime Location Public Housing for HDBs. Will these eventually cause a slowdown in the HDB market? No one will know for sure, but how much further can the prices of HDB continue moving upwards? Figure 1 clearly shows HDB prices hitting a new peak. With that in mind, what should HDB owners do?

Looking at Figure 2, comparing the prices of a 5-bedroom at for Punggol in 2012 & 2019/20 respectively we can see a stark difference of $200,000. What a painful loss for those who held onto their ats! In hindsight, with the right advice and immaculate timing, such things can be avoided.

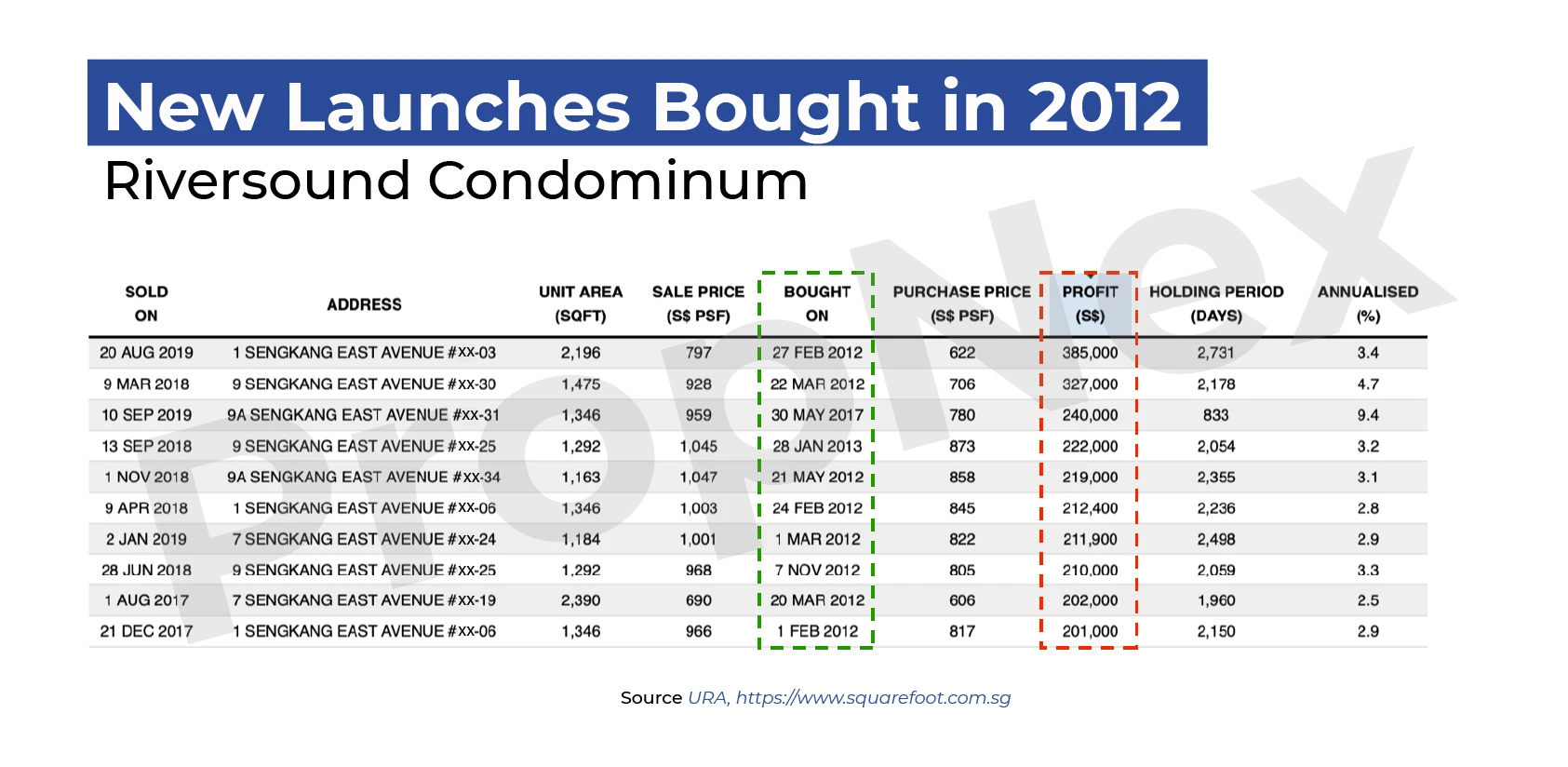

Imagine you are one of those well-informed discerning owners who exited at the right time and went on to buy a private property at Riversound condominium in 2012. You would have easily made a whopping profit of $300,000 on average as seen in Figure 3 below.

By now, many of you are probably thinking this is easy to say looking at all these charts and figures in retrospect. One of the biggest concerns you’d probably have is if you could pay off the monthly mortgage loans without over-leveraging? Well, the fact is, it might not seem easy when you do not know what options are available to you! The important thing when making such decisions is to work out a financial plan. With a full-proof plan, many HDB owners managed to upgrade hassle-free and live without the stresses of mortgage loans.

Hit me up via WhatsApp if you hope to avoid being in the same predicament as the unfortunate case of the old couple above or want to know how to avoid losing unnecessary money. Let me show you how to steer clear of all these mistakes and how you can actually take advantage of your HDB at given the appropriate timing.