Buying a home always seems daunting especially such it is a big-ticket item and particularly since private homes often start at a million dollars. However, by having the ability to analyze the numbers to have a clear overview of your financial capacity to handle monthly mortgage payments, you may find that owning a private home is much more feasible than expected.

A major benefit of consulting through me is that I have access to exclusive financial planning tools. These tools are incredibly helpful in mapping out your finances, providing you with a clear plan, and giving you the confidence to move forward with your home upgrade. After all, property is one of the largest purchases in life and it is vital to ensure that you are not jumping into anything blindly.

Consider the following case study: Sam and Jane currently own an Executive Condominium (EC) and are interested in selling it to purchase two new properties. In this scenario, how can my exclusive financial planning tools assist them?

The exclusive financial planning tools provide an evaluation of your financial situation and determine the feasibility of your target home purchase. With this, you can quickly calculate your cash on hand and CPF funds, and use this information to calculate your monthly mortgage payments based on the property's purchase price. By taking into account your financial resources and obligations, this tool provides an accurate assessment of your affordability for the property you're considering. This information can help you make informed decisions about whether to proceed with your purchase or explore other options.

Having a clear understanding of your financial limits and comfort level with monthly payments is crucial when making real estate decisions. By carefully evaluating your financial situation, you can make more informed moves and avoid taking on unnecessary risks.

Understanding clearly what your limits are and how comfortable are you with the monthly payments will empower you to make more informed moves. As you can see from Jane's breakdown of figures, at the bottom, it clearly details the monthly mortgage repayment needed in the different phases of construction if it is a new launch.

One point I feel strongly about, in fact, an important point that I have been advocating for years is that no matter how hard we work and save up, we can never beat those who make their hard-earned money work for them through property. This is why I endeavor to equip homeowners with the ability to make informed decisions that will impact their future, both for them and their families!

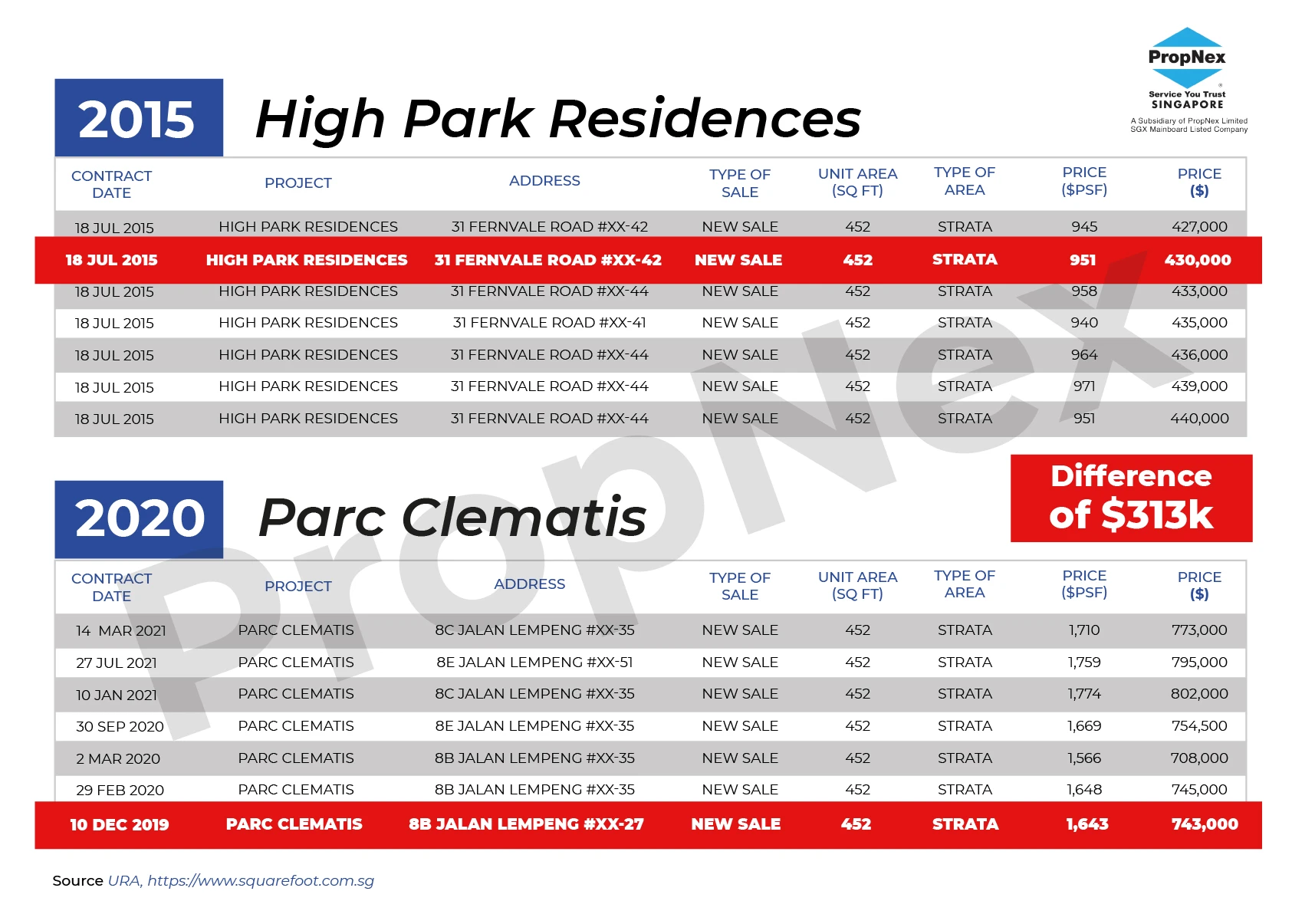

The average income growth rate of a mediocre 2.4% annually (Figure 1), compared to the phenomenal profits of $300,000that can be achieved through property investment in 3-4 years. We can safely assume that you and most people would want to make that profit too, right?

In Figure 2 below, we can see a comparison of two similar unit types in different locations. Even though they target the same market audience, their prices can differ significantly in just under 5 years. Therefore, your inaction can actually cost you dearly without you even realizing it.

And based on the reality of income growth, bonuses, and savings, are you able to even generate any amounts close to such returns? The answer is cruel but real. Now is the optimal time for you to make a life-changing decision, enjoy a huge leap in this rat race, and seize this opportunity to provide your family with the best while you still harness the capacity to work hard, make a decent income, and youth to enjoy maximum loan tenure. You don’t have to look at others in envy thinking that they got lucky or are blessed enough to enter the property market and are making a splash, you can be that person too!

With so many questions involved, there are many crucial choices to make as a property upgrader. At the end of the day, everyone wants financial freedom, and not to be burdened by monetary issues, especially at every stage of one’s life. Attaining financial freedom is definitely possible, with meticulous planning and commitment. There is so much to benefit from when you make the right choices, and the first right choice to make now is to click the button below to reach out to me via WhatsApp to explore your options and see how you can make your hard-earned money work for you.