Entering A New Era

With the advancement of technology and the easy access to information and data, consumers now have the opportunity to study property trends from the comfort of their study rooms. This is a wise approach, considering that property purchases are typically the largest investments in most people's lives. Making the right or wrong choice can have a profound impact on short-term and long-term outcomes. As a result, some individuals are able to upgrade to larger homes or own multiple properties despite modest income growth, while others may struggle to progress due to poor choices.

The real estate market in Singapore is incredibly dynamic, with hundreds of transactions taking place every day, including new launches, resale for private and HDB. An active real estate consultant is one who remain closely involved on the ground, staying updated with the latest information even before it becomes available on the internet a month later. For myself, this not only provide me fresh market sentiment but also enables me to analyze the market and projects holistically, allowing me to offer the best advice and increase the chances of generating the good return on investment.

Of course, it's important to note that every agent has their own perspective, and I don't claim to be the best. After all, it's impossible for anyone to make such a claim definitively. However, what I can offer is a collection of case studies showcasing the actions taken by buyers and the results they have achieved as a result for reference.

Two Types of Consumer, Which One Are You?

Before going into the case study... I noticed there are 2 types of consumers:

Type 1: General consumers, tend to get excited about the product itself in the earlier part of the consultation which is understableable.

Type 2: Rational consumers, there will always be a small group who tend to be more logical and value insights before starting anything.

Personally, I will suggest my clients to contain the excitment and take a step back to understand what they are getting into before shortlisting their options. Rather than product pushing, I often share with my friends and clients on the current market sentiment and what are the blind spot and important point to look out for. Such as:

- How to time the market cycle?

- Purpose of Real Estate

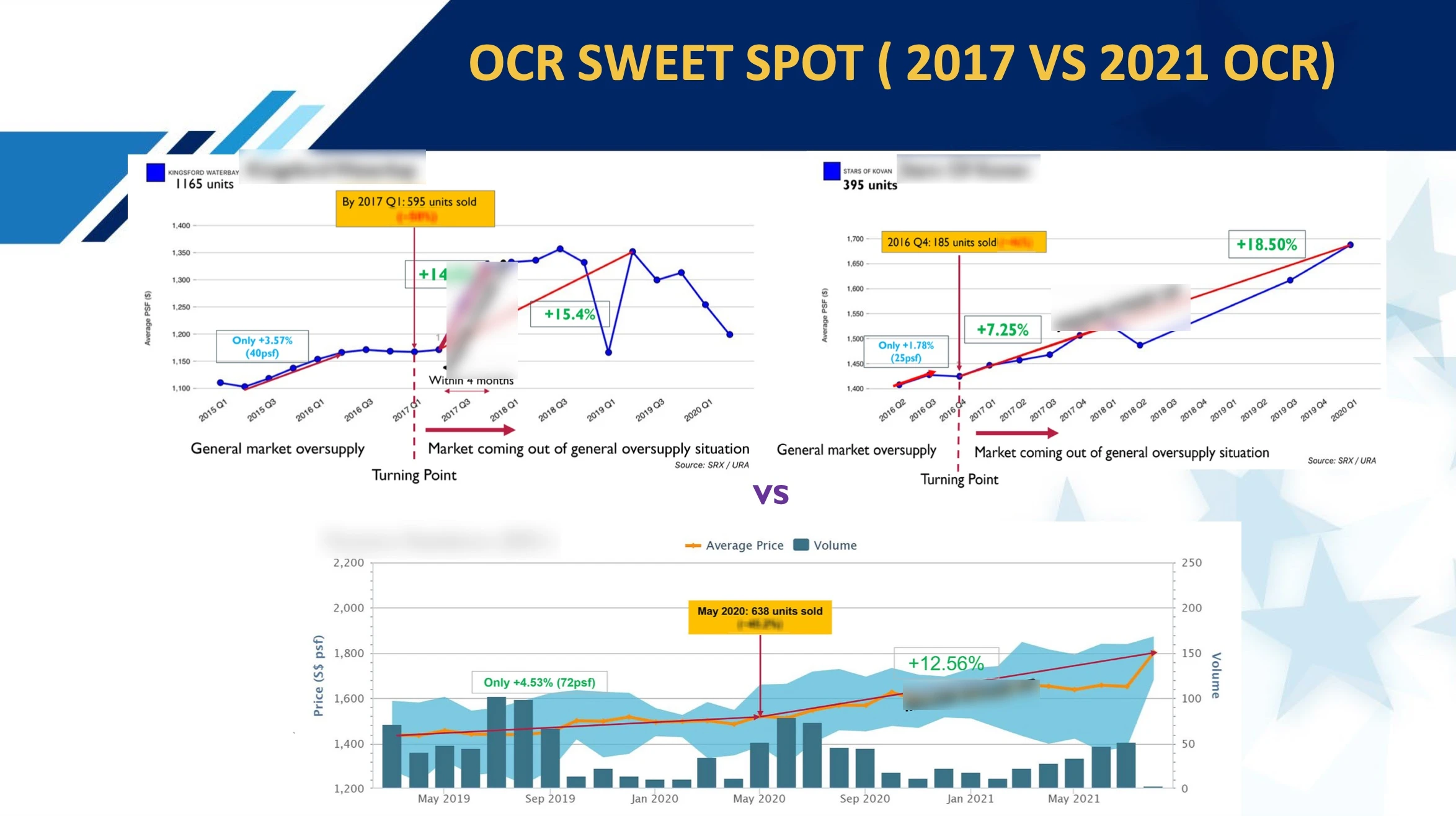

- How can you capitalise on the Market Sweet Spot that can generate 15% return in the shortest time?

- Why cooling measures form the new 'low' point of the next market cycle?

- How to identify the right and safe entry?

- How to capitalise safely in each interest rate environment?

- With interest rate at its all time high currently and property price continue to grow over the last few quarters. What will happen when interest rate falls?

- Above all, how to capitalise safely in the current environment?

So what exactly is all of these? Here's a quick look!

Topic 1. How To Time The Market Cycle

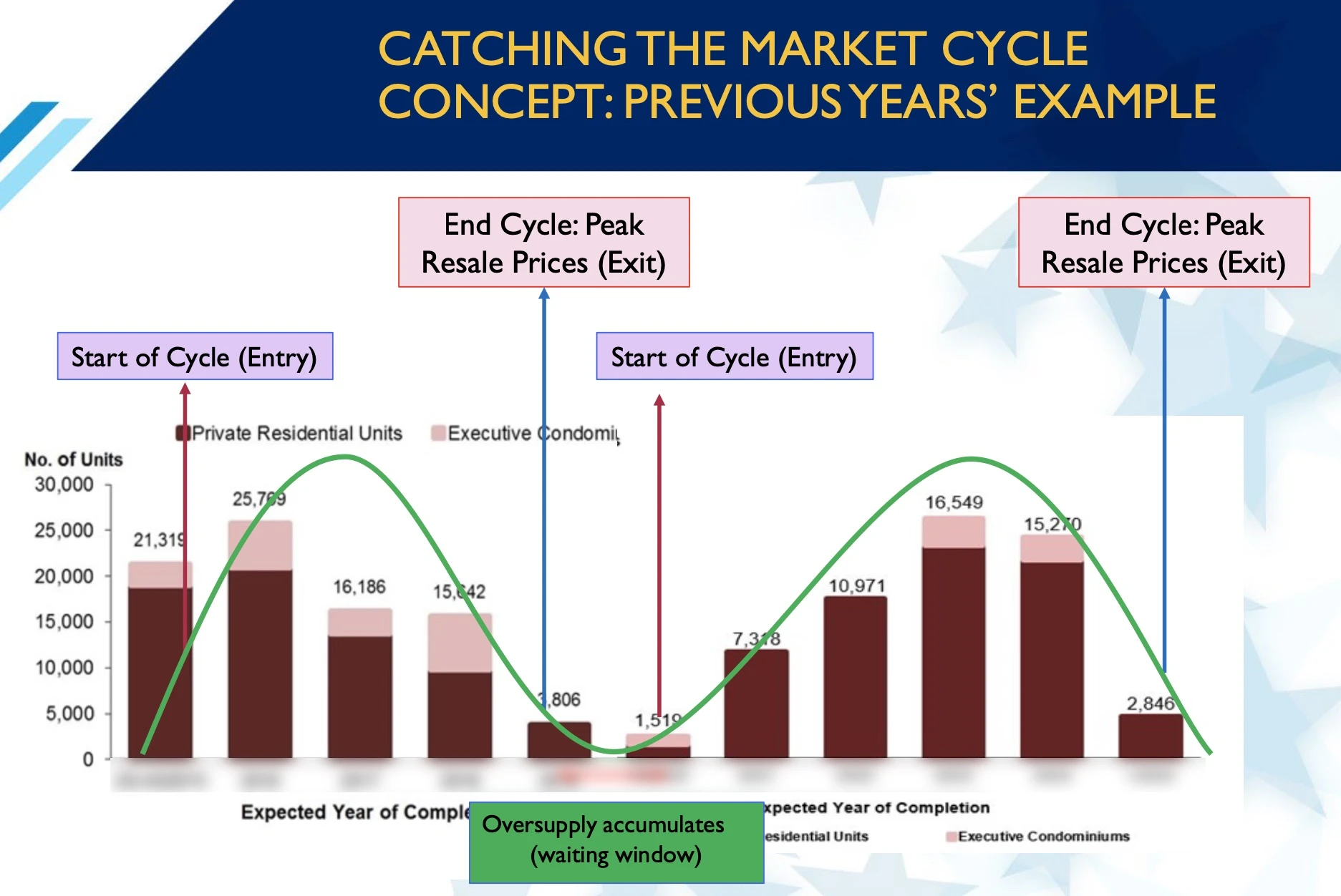

Understanding the Singapore real estate market cycle is key to determining the optimal moments for entering and exiting the market. By closely monitoring and researching the supply pipeline in Singapore, we can stay well-informed about the market cycle year after year.

Exiting the market at the peak or non-peak periods can have a substantial impact on profits, even for the same property unit. Ultimately, we all want to buy low and sell high, don't we?

Topic 3. How can you capitalise on the Market Sweet Spot that can generate 15% return in the shortest time?

Frankly 15% ROI is an esimate, it can be lower, or higher. The actual growth will depend on several factors. This need for topic 3 arose from frequent questions during consultations, particularly from product-focused clients in the early phase.

"Samuel, this project/unit can buy or not?"

"How about this one leh, can make money or not?"

"This is not a new launch leh, still can buy ah?"

I do not have crystal ball and that's why I cannot predict the future. Which is why I rely on extensive research and trends observed over many years to identify the Market Sweet Spot. This helps determine if a development offers a SAFE ENTRY point with upside potential. For instance, in the case of an uncompleted project, developers typically launch it at the lowest price and gradually increase prices over time. This pricing strategy often raises concerns among buyers that the prices have become "too high," potentially hindering future appreciation that you are looking for, or leaving them financially constrained and never be able to exit.

Identifying the Market Sweet Spot becomes crucial in such situations, as being able to capitalise on these untapped opportunities that others may not be aware, provides an edge over those lacking this knowledge.

Ultimately, would it be better to be equpied with the ability to identify 'can buy or not', rather than just relying on agents telling you that it is a good buy? Chances are as long as they know that you are interested in this development most agents will always tell you 'Yes! can buy!' to seal the deal.

Topic 4: Why cooling measures form the new 'low' point of the next market cycle?

Cooling measures, the infamous stunt pulled by government these days at midnight (to prevent last minute transactions) often leave real estate agents sleepless. The following day, our phones are flooded with messages from friends and clients seeking insights into the market's impact. It's during these moments that I realize people in Singapore are well-versed in two things: their day jobs and real estate.

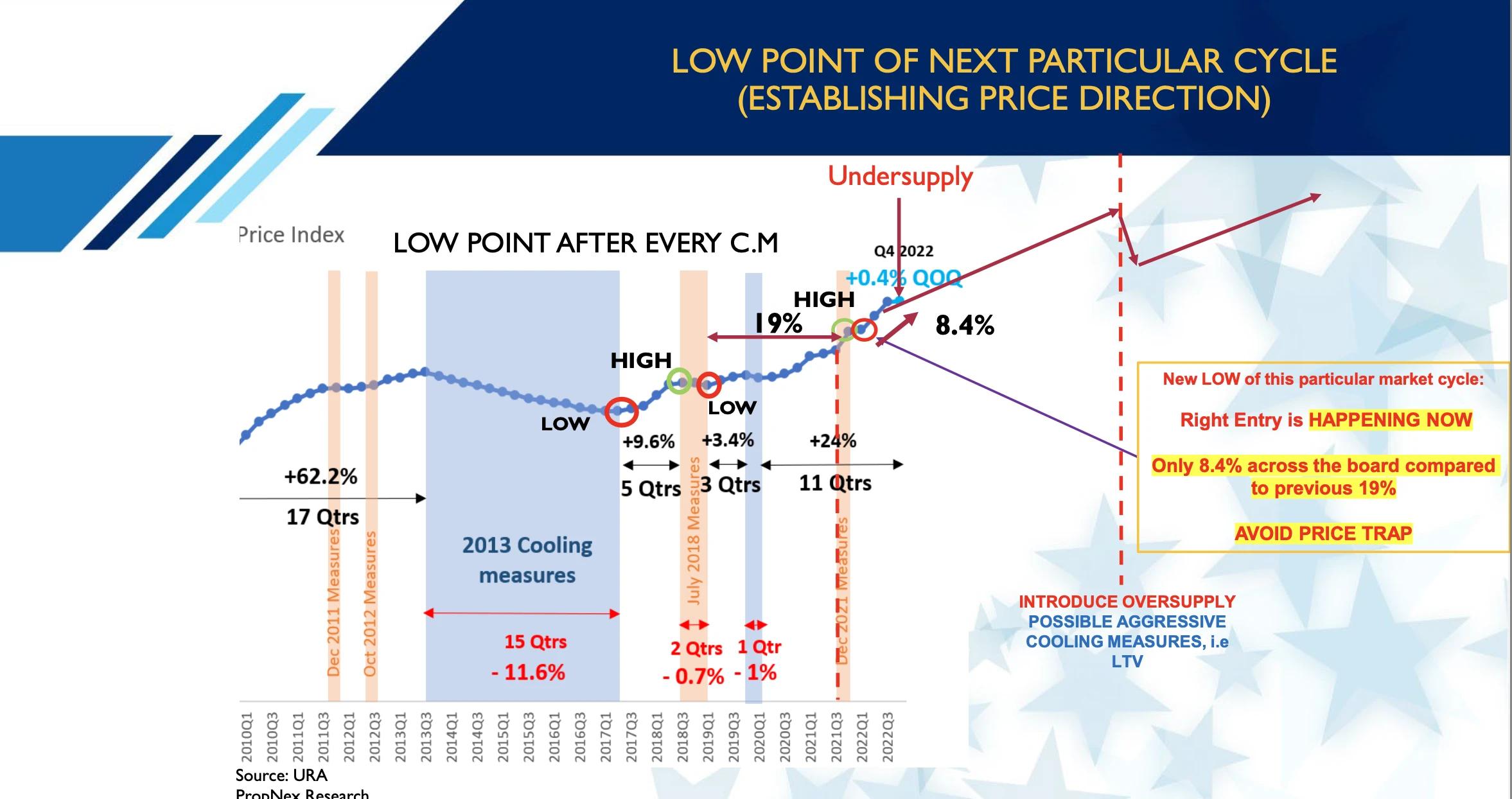

After years of observation, a pattern emerges: after every cooling measures a new low point of the next cycle will be formed.

Again, it is always about buying low and selling high isn't it? After the cooling measures in 2013, a new low point is formed and likewise after the cooling measures in 2018 a new point is also formed.

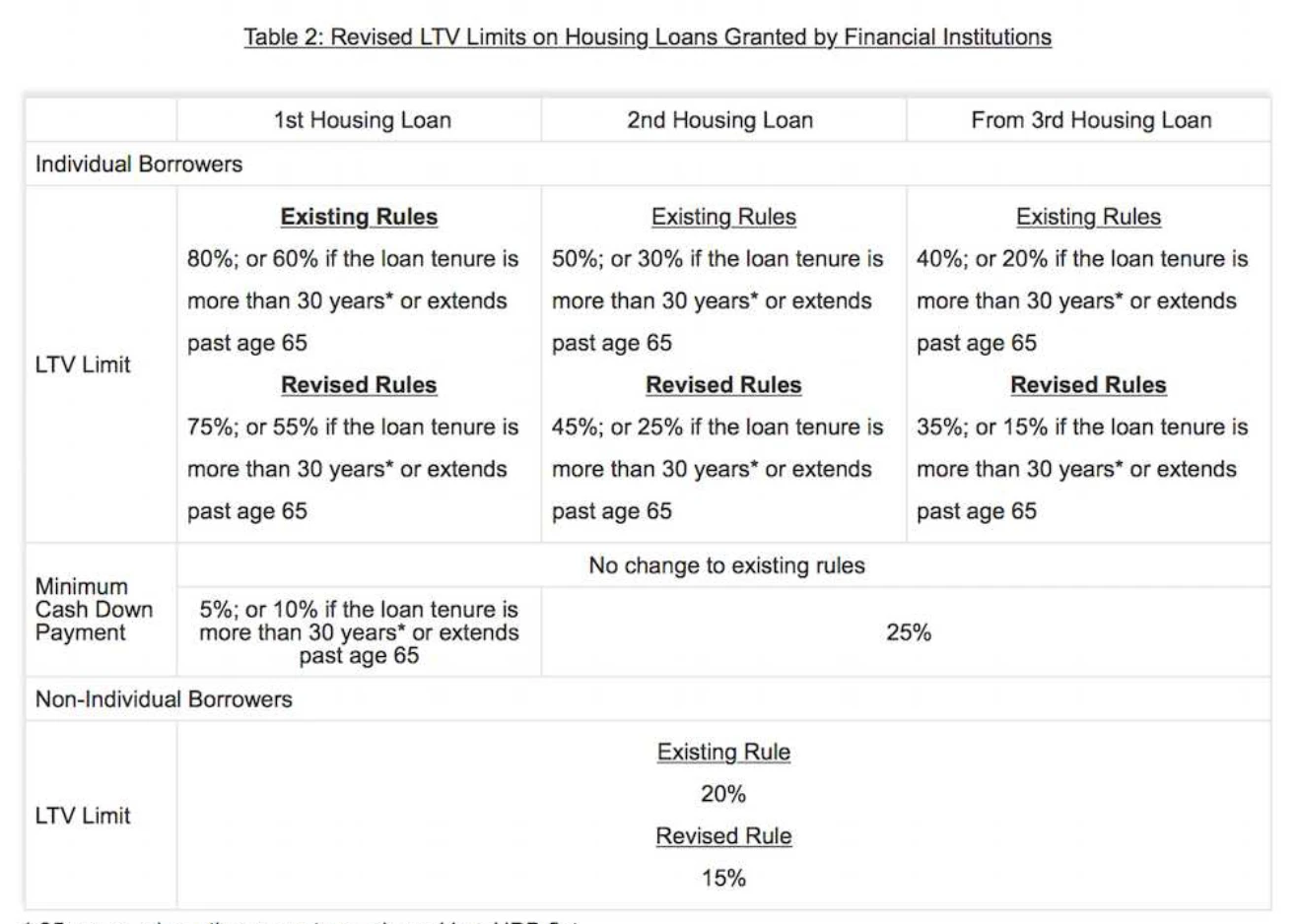

Back in 2018, when the LTV decreased by 5% following a cooling measure, some buyers hesitated. However, those who understood and took advantage of the low point in the cycle and purchased at Florence Residences ended up with significant profits in just 3 years.

While it's true that the market generally follows an upward trend, especially post-Covid-19, and owning property typically leads to positive returns. The purpose of identifying the low point of the cycle is to help investors to, purchase low and maximise profits to the fullest extent. Given the choice between a 3% gain and an 8% gain within a similar timeframe, which would you prefer?

That's 3 sneak peak from a small part of each topic, out of a total of 8 topics that I usually cover. I would love to share the full thing with you but it is impossible because even going through in person verbally will require a minimum of 45 minutes. If you would like to learn about the full thing, book a slot here I will be happy to share it with you over tea.

Case Study:

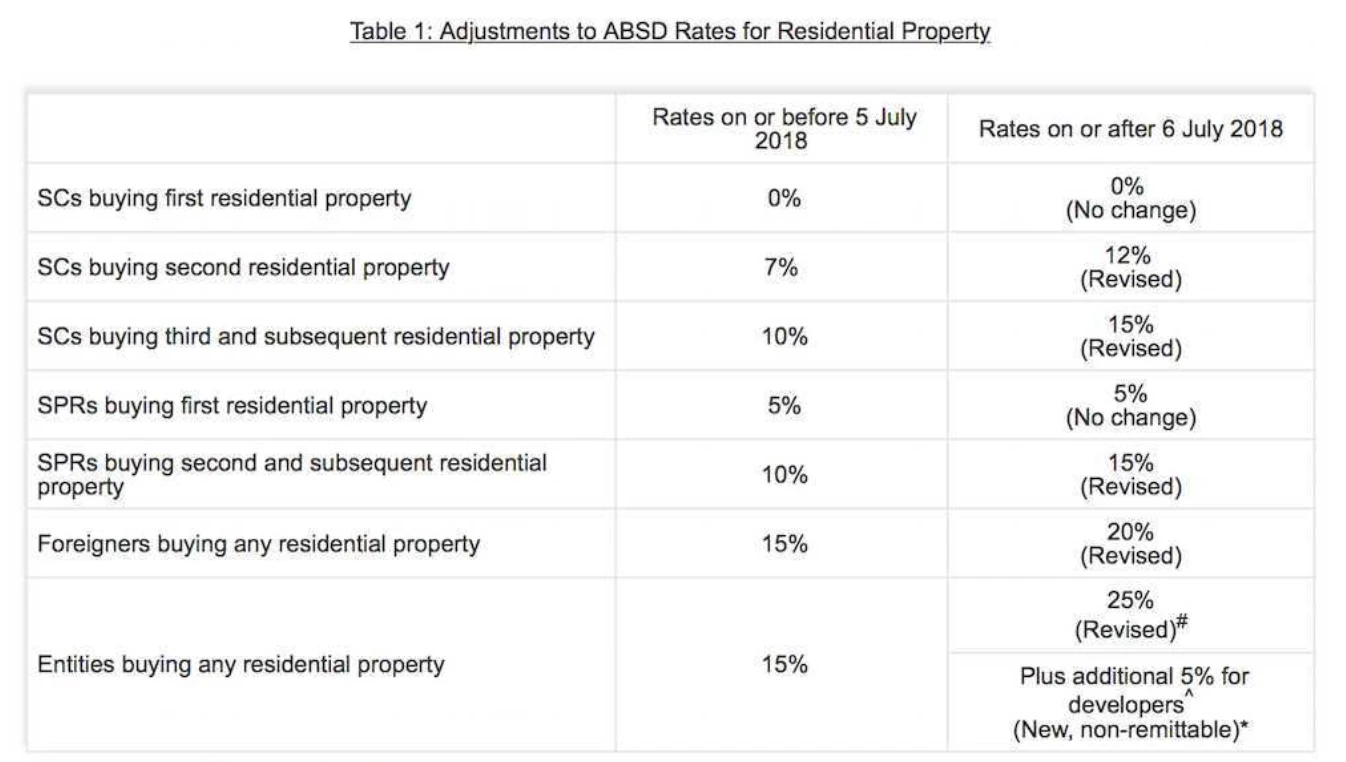

6 July 2018 is a memorable day in the real estate market as a new wave of cooling measures were introduced. Specifically.

- ABSD Adjustment, Increase by 5% Across the Board: The dream of owning more than 1 property in Singapore became more costly

- LTV Adjustment. Drop from 80% to 75%: With a lower loan amount can be granted, more cash upfront required

In short, more money is required to own the same property and purchasing got more difficult.

While a small group of buyers may face pricing challenges due to budget constraints, it is unfortunate but inevitable. On the other hand, a larger group of buyers who possess the financial means to withstand the introduced cooling measures must make a decision about their course of action. After all cooling measures is negative news, not everyone can immediately accept it, leading some to adopt a 'wait and see' approach.

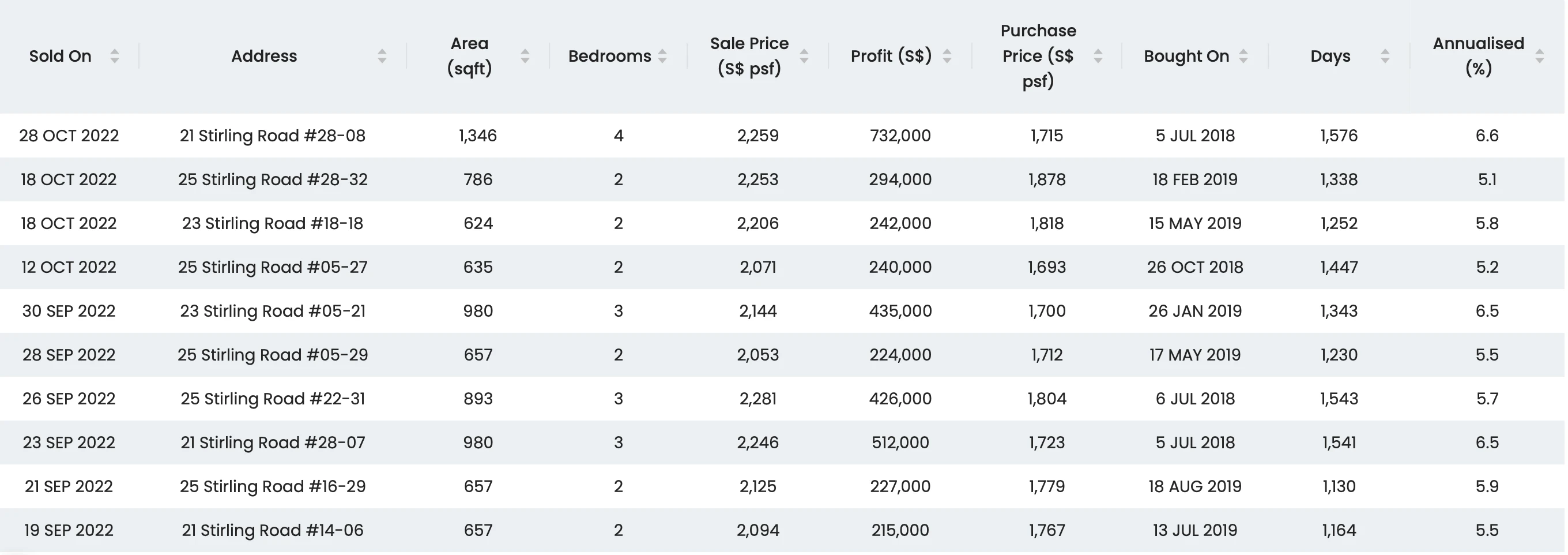

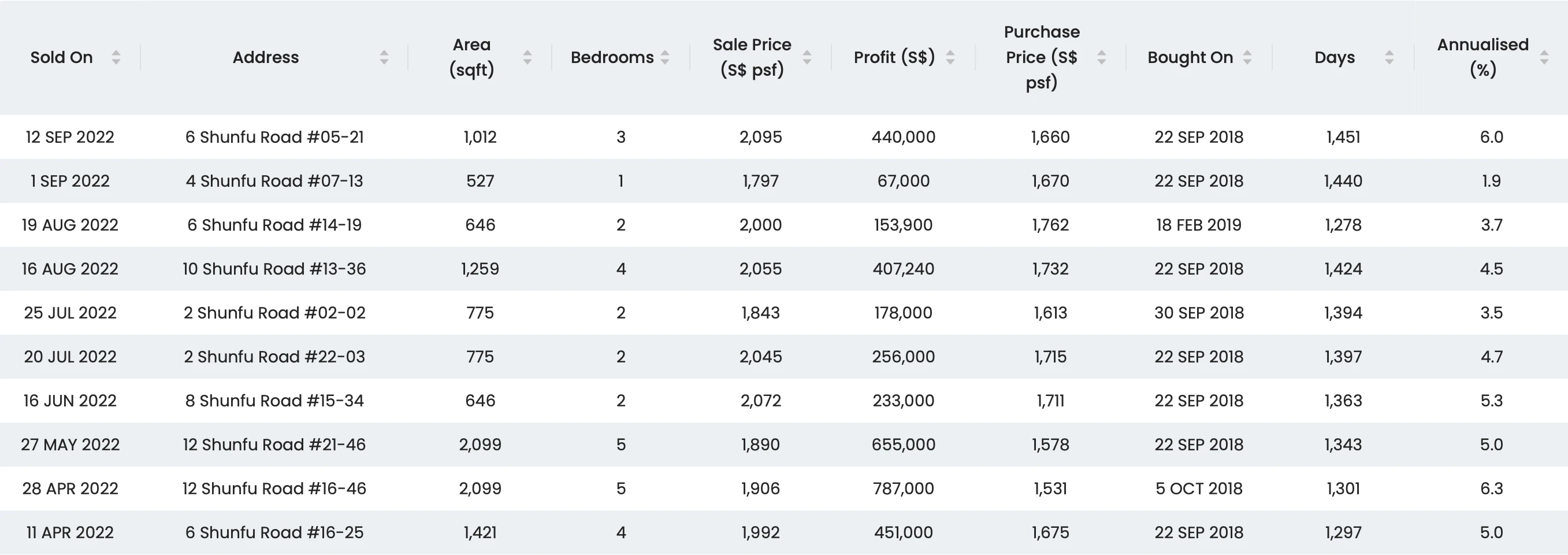

In such adversity, it is important to be more prudent and perform more research before making any decision. Below are some of the result of investor and homebuyers who understood the above topics, took advantage of the low point of the next cycle after the cooling measures, and were able to filter the noises and take action confidently after identifying the safe entry. Buying in at the low point and selling high at the peak.

New Launches

Stirling Residences

(source: Edgeprop)

Jadescape

(source: Edgeprop)

(source: Edgeprop)

Resale

Collective of Resale Condos

(source: Edgeprop)

In this digital age, accessing data has become easier than ever, leading to the ability to draw certain conclusions. However, combinning data and the ability to analyze it structurally coupled with actual market sentiment can greatly help you to make a more informed decision and SAFEGUARD your exit even before purchasing.

So next time, rather than solely focusing on micro aspects such as the property itself, its proximity to amenities like MRT stations, schools, and malls, I strongly recommend dedicating time to understand the macro aspect—the bigger picture. Of cause if you wish to shave down the research time spent and learning curve, the above topic for sharing is always available for you as long as you reach out to me.

As you can see, due to the comprehensive nature of these topics, the sharing session is not a brief 20-minute, 10-slide presentation. It typically takes about 45 minutes to 1 hour to cover all the essential information. Is that very long? It depends on perspective. Consider that individuals can spend $3000 for a 'property investment 5-day course' on similar content elsewhere, is 45 minutes very long here?

By condensing the material and remove unnecessary elements like coffee breaks and networking sessions in those workshop, I empower you with all the essential knowledge about real estate in Singapore, including the latest market sentiment, within just one hour. Furthermore, if we can spare 45 minutes to watch a troubleshooting video on YouTube on a broken object, is it reasonable to invest the same amount of time to learn and SAFEGUARD the most significant purchase in life?

If you are looking to restructure your property portfolio, upgrade from a HDB to private or purchasing your first home, Simply book a slot here, and I would be happy to take 45 minutes to share the above topics with you to aid you in your research and make a more informed decision.